Most people think crowdfunding is a new way to raise capital, but what the majority of them do not realize is that this strategy has actually been used for thousands of years.

Crowdfunding is a method of fundraising whereby many small investors pool funds as a group to reach the desired capital goal. It is a practice that has become very popular on the internet in recent years. However, charitable contributions – one of the four main forms of crowdfunding – date back to the ancient Greeks who invented philanthropy and believed in pooling resources to provide for the underprivileged. The Catholic Church serves as another example, collecting donations from members to fund operations since the year 1 A.D.

Since that time, crowdfunding has changed and evolved and can now be divided into four primary categories: equity-based, lending-based, donation-based, and rewards-based. Equity crowdfunding is a traditional exchange of cash in exchange for an ownership stake in the company, a transaction that was not possible until the 2012 passage of the JOBS (Jumpstart Our Business Startups) Act. Lawmakers have yet to finalize the details surrounding the equity method, but the ultimate goal is that non-accredited investors will be allowed to participate in such investment schemes.

Lending-based crowdfunding is a debt transaction where investors exchange capital in return for a promise to return the funds plus some amount of interest.

Finally, donation-based crowdfunding efforts ask investors for money in exchange for nothing whereas the rewards-based method offers perks in return for capital. The latter can be a very smart choice or a very poor one. For most ventures it will likely end up having negative signaling effects.

I can already hear the negative reactions and anticipate all the comments from irate individuals who love the concept of rewards-based crowdfunding. But despite such reservations, we must still ask ourselves this question: Is using rewards-based crowdfunding a bad choice for most ventures?

Although I would answer with an astounding “yes,” that does not mean that crowdfunding itself is a horrible idea. In fact, as I alluded above, if done properly, rewards-based crowdfunding can be quite attractive. The reason rewards-based models are typically suboptimal is due to the way entrepreneurs have attempted to leverage such methods in recent years. Founders are likely to choose rewards-based crowdfunding in order to keep as much equity as they can prior to a larger fundraiser down the road. And although I applaud them for their foresight to hoard potentially valuable equity, rewards-based crowdfunding efforts can create very negative signaling effects. That being said, there are ventures with very sound strategies for which rewards-based crowdfunding can produce significant positive signals, ultimately proving to be the best choice out of all possible fundraising methods.

A Quick Lesson in Signaling

In 2001, Michael Spence, George Akerlof, and Joseph E. Stiglitz were awarded the Nobel Prize in Economics for their research of markets with asymmetric information. Their findings were in part based on Spence’s theory of signaling. According to Spence, signaling is the act by which an agent shares information with its counterparty (the principal) through its actions. More so, the principal is able to infer certain information about the agent based on the action he or she takes without such information being directly communicated. For the sake of this discussion, companies raising money are the agents, and potential investors are the principals. When asking the public for money, the size and valuation of the contribution, the way in which the contribution is solicited, and what the contributor receives in return all signal the worthiness as well as the state of affairs of the company. Using the information disseminated from the signal, principals can go one step further and evaluate whether or not to invest in a company. Let us look at an example.

For the sake of simplicity, we will say the agent is the founder of a company manufacturing the newest type of widgets. Their cost per unit is $0 while the price is $100. In order to get the company off the ground, they need an initial outlay of $1,000,000. Let us go one step further and say the initial growth rate is 0 percent and the current market’s cost of capital is 10 percent. Now, assuming the market believes the agent will have 3,000 customers per year, we will cover four potential scenarios. Additionally, in the event of a rewards-based crowdfunding campaign, the reward is a discount for consumers participating in the presale of the cutting edge widgets. The price for a presale widget is only $50. Note: the price has to be significantly lower because the consumer is taking a risk by buying something before it is built, tested, and ready to be shipped.

At $100 per unit, the market believes the agent can sell 3,000 units per year resulting in $300,000 at the end of year one. In order to figure out the implied present value of the firm, we discount that back at 10 percent (the current cost of capital) totaling $3,000,000 present value. Because the agent needs $1,000,000 to get the company up and running, we can deduce that they must sell one-third of their equity.

Model 1: Bullish Agent Using Venture Capital Equity Financing

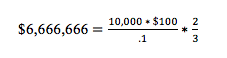

The agent is bullish and believes they will sell 10,000 units rather than the 3,000 the market has projected. According to their bullish projections, the remaining two-thirds of equity create a wealth of $6,666,666 for the agent.

Model 2: Bullish Agent Using Rewards-Based Crowdfunding

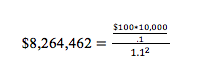

The agent is bullish and decides to presell the 10,000 units they project but only at $50 per unit resulting in revenues of $500,000. It takes the company two years to raise the required capital to start the project. When calculating the agent’s wealth, we only take into account revenues once they start making money. After two years they will make $1,000,000 per year in perpetuity. That equates to a wealth of $8,264,462.

Model 3: Bearish Agent Using Venture Capital Equity Financing

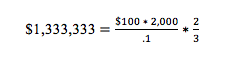

The agent is bearish and believes the market has overestimated his ability to sell cutting edge widgets. He only thinks 2,000 units will be sold during the year. After selling off one-third of his equity, the agent is left with $1,333,333 of wealth.

Model 4: Bearish Agent Using Rewards-Based Crowdfunding

The agent presells 2,000 units at $50 per unit totaling $100,000 per year, meaning he would need 10 years worth of presales to get the operation off the ground. The agent keeps all of the equity for himself and thus only starts receiving value once the first 10 years are up. The firm makes $2,000,000 per year in perpetuity which leaves him with a wealth of $771,086.

Let us examine what just happened. If we compare the two bullish models to each other (models 1 and 2) and the two bearish models to each other (models 3 and 4), we can learn a lot. When the agent is bullish, rewards-based crowdfunding is clearly the best choice because it creates the most wealth for the agent. On the other hand, when the agent is bearish, venture capital equity financing is the best choice because it produces the most wealth for the agent. Taking it a step further, we can pretend to be the principal. Having done our due diligence running projections through our advanced Microsoft Excel spreadsheet models, we would get close to the same conclusion. Therefore, we can back into the assumption that when the agent chooses rewards-based crowdfunding, he is bullish on his potential outcome whereas he is bearish if he chooses the venture capital equity financing. The former sends a positive signal while the latter sends a negative one. The implicit message in the agent choosing rewards-based crowdfunding is that their equity is too valuable to exchange for funding and that the product is so good people should be willing to give up their hard earned dollars to get it. On the other hand, the signal sent by selling equity to raise the required working capital is that the equity is not as valuable as its being marketed because; one, the agent is willing to part with it; and, two, the agent is not sure of their ability to sell the widgets.

Takeaways

This all sounds pretty cut and dry, but we can draw important conclusions to this lesson. If you ignore everything else I have said, at least remember that in order for the rewards-based method to work, the company needs to meet three criteria:

1) The agent must be bullish about their future performance.

2) The business cannot be capital intensive. If it is, it will take too long to recoup the initial outlay as evidenced by Model 4.

3) The good must be a Search Good – it must have features and characteristics that are easily evaluated and understood before the purchase. Basically, the consumer must be informed about your product in advance.

If these three criteria are met, then and only then, do I recommend proceeding with a rewards-based crowdfunding campaign.

Further, if you want to look at a great example of a company meeting these criteria, take a look at Coin – a new take on traditional credit, debit, and loyalty cards. Coin allows an individual to load multiple cards onto one card to reduce the size of their wallet. Coin’s fundraising strategy along with its marketing strategy was genius. In order to raise the funds they needed to kick off the project, Coin started a $50,000 reward-based crowdfunding campaign. They pre-sold Coins which normally go for $100 for only $50. Sound familiar?

The result was nothing short of spectacular. On November 14th, 2013 Coin launched their $50,000 Kickstarter campaign and hit their goal of 1,000 presales in 47 minutes. That is not a typo! How did they do it? Coin released a video on Facebook which educated the consumer on the new technology and it quickly went viral. Additionally, they limited their raise to the minimum needed to begin manufacturing which implied a scarcity in supply. The amazing part from Coin’s perspective is they did this all without giving up any equity in the company. Now when they decide to raise a large round from VCs, the community will be banging down their door to get a piece of the deal and, what is more, they will be offering a great valuation.

The moral of the story is reward-based crowdfunding may be the new, hot way to raise money on the street, but be careful. Don not forget that the method of fundraising you choose, the valuation and size of contributions, and what the contributor receives in return for their money will all send a signal about your company to potential investors.